Car buyers have clear expectations, and certain factors can be dealbreakers. To understand what influences their decisions, we surveyed 1,006 Americans currently shopping for or considering a vehicle. Our findings reveal the biggest reasons buyers walk away, what makes them switch brands, and the key barriers to EV adoption.

Key Takeaways

- Used car buyers are 15% more likely than new car buyers to walk away over high prices.

- 31% of car buyers have switched brands at the dealership because a vehicle was missing a key feature, with Tesla owners (51%) being the most likely to do so.

- 36% of car buyers are interested in using an AI chatbot during their buying experience.

- 26% would trust AI-driven car recommendations over a salesperson's advice.

- 1 in 6 car buyers considered buying an EV but changed their mind at the dealership.

- The biggest hesitations about buying an EV are the high upfront costs (22%) and the lack of charging stations (20%).

Top Dealbreakers for New and Used Car Buyers

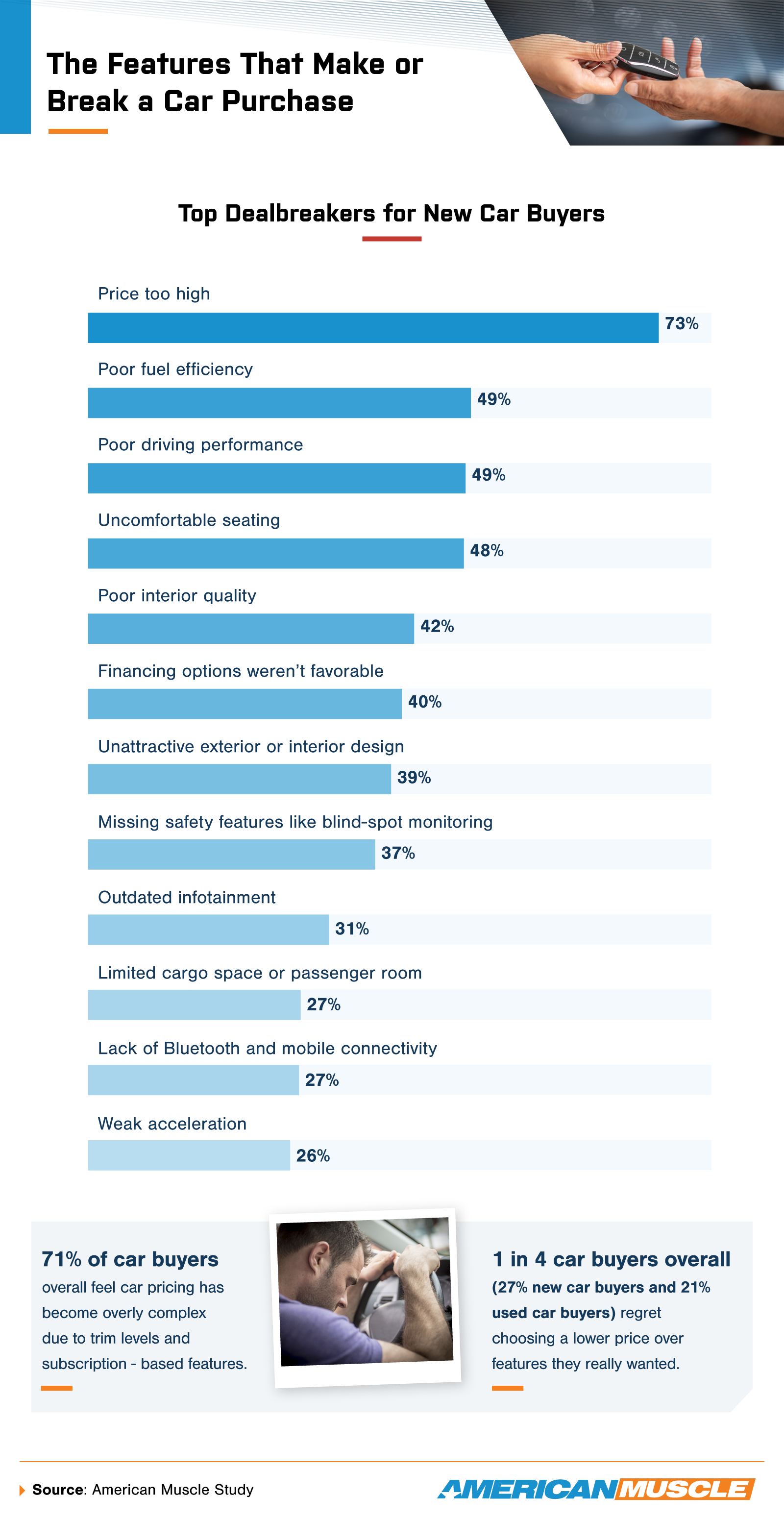

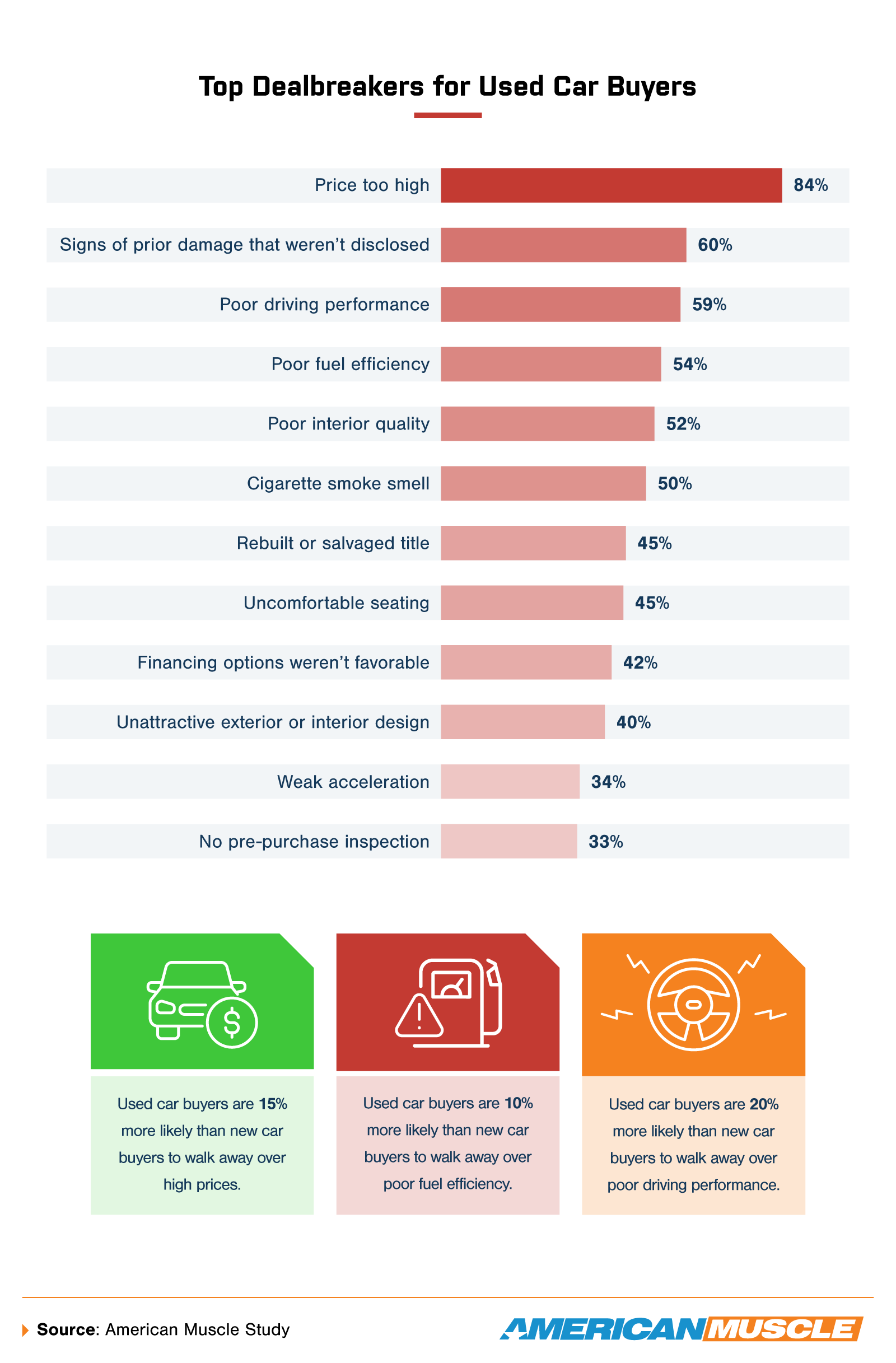

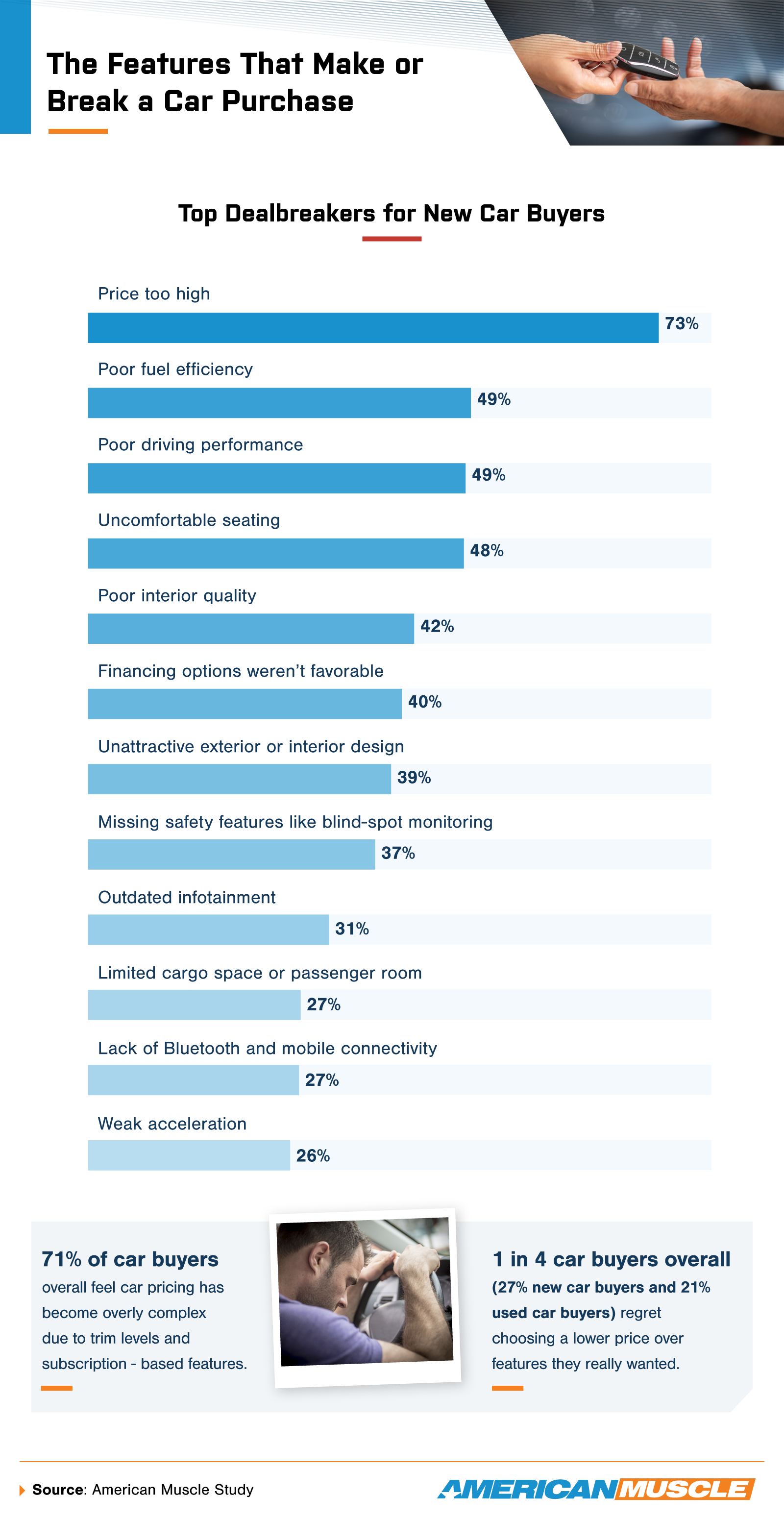

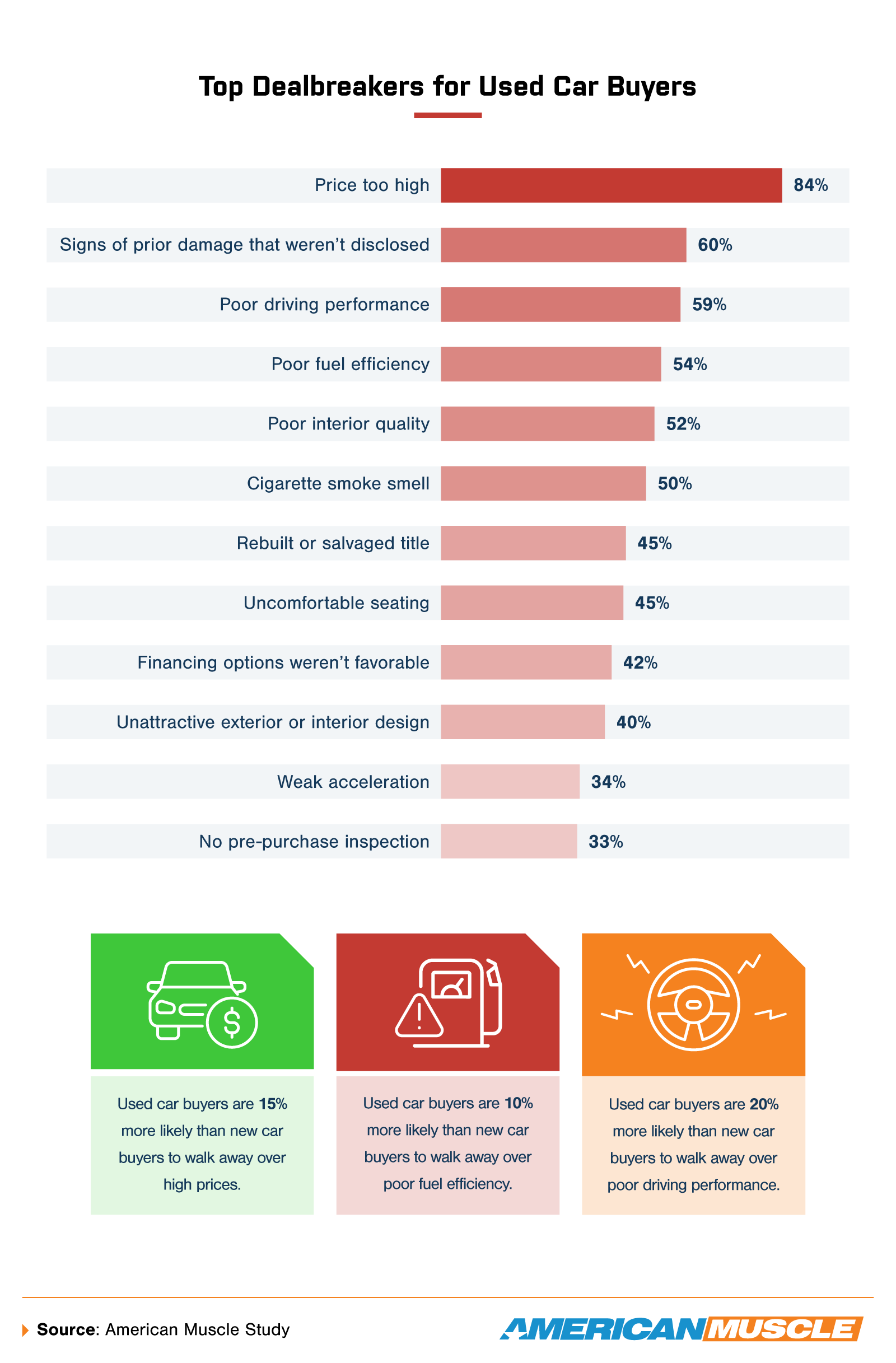

Car buyers have clear priorities when shopping for a vehicle, and certain factors can make or break a deal. Whether purchasing new or used, things like price, safety, and technology heavily influence their choices.

Price was a bigger dealbreaker for used car shoppers, who were 15% more likely than new car buyers to walk away over high costs. Among new car buyers, Gen Z placed the highest importance on safety and technology — 53% wouldn't buy a car without key safety features, and 37% rejected vehicles with outdated infotainment.

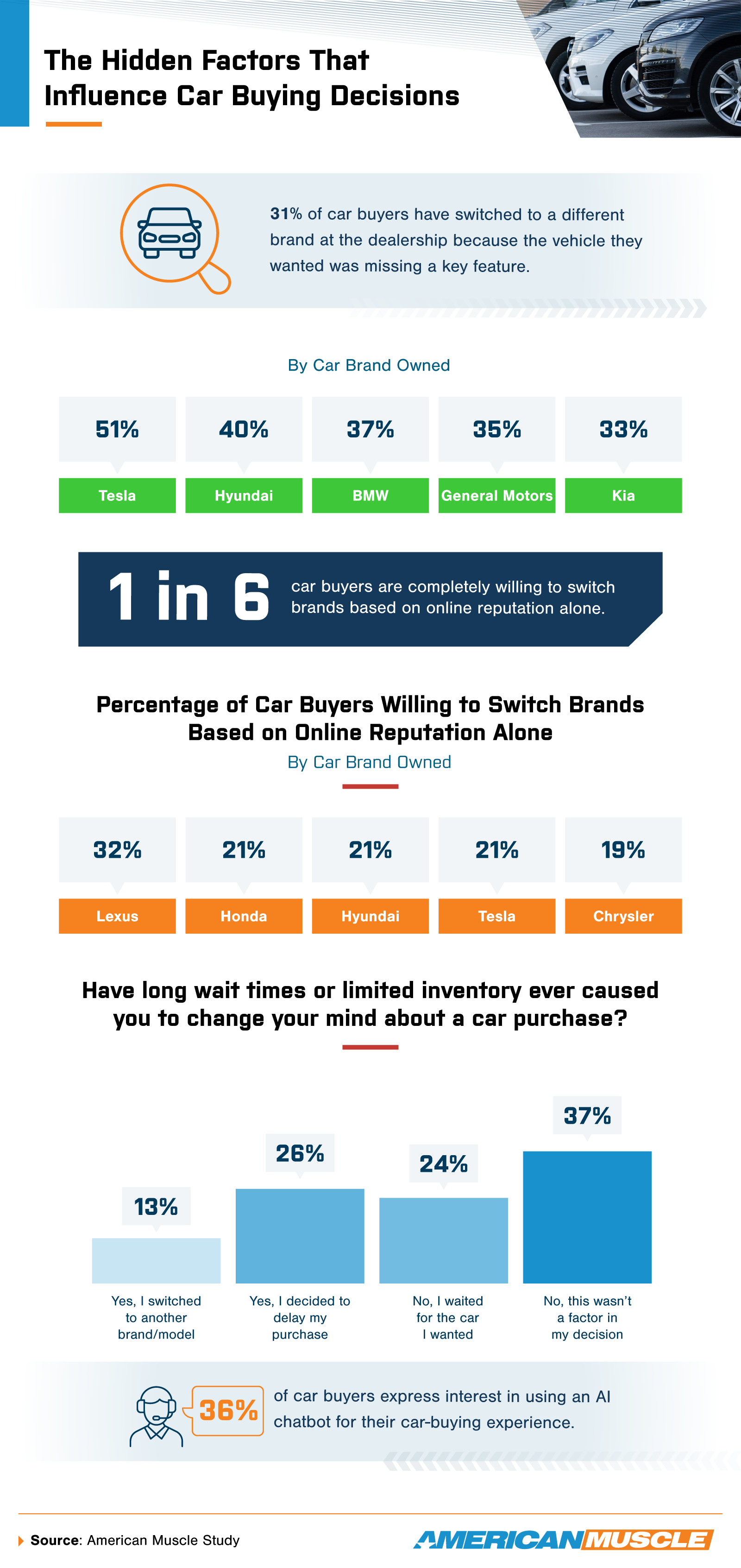

Brand Loyalty vs. Feature Expectations

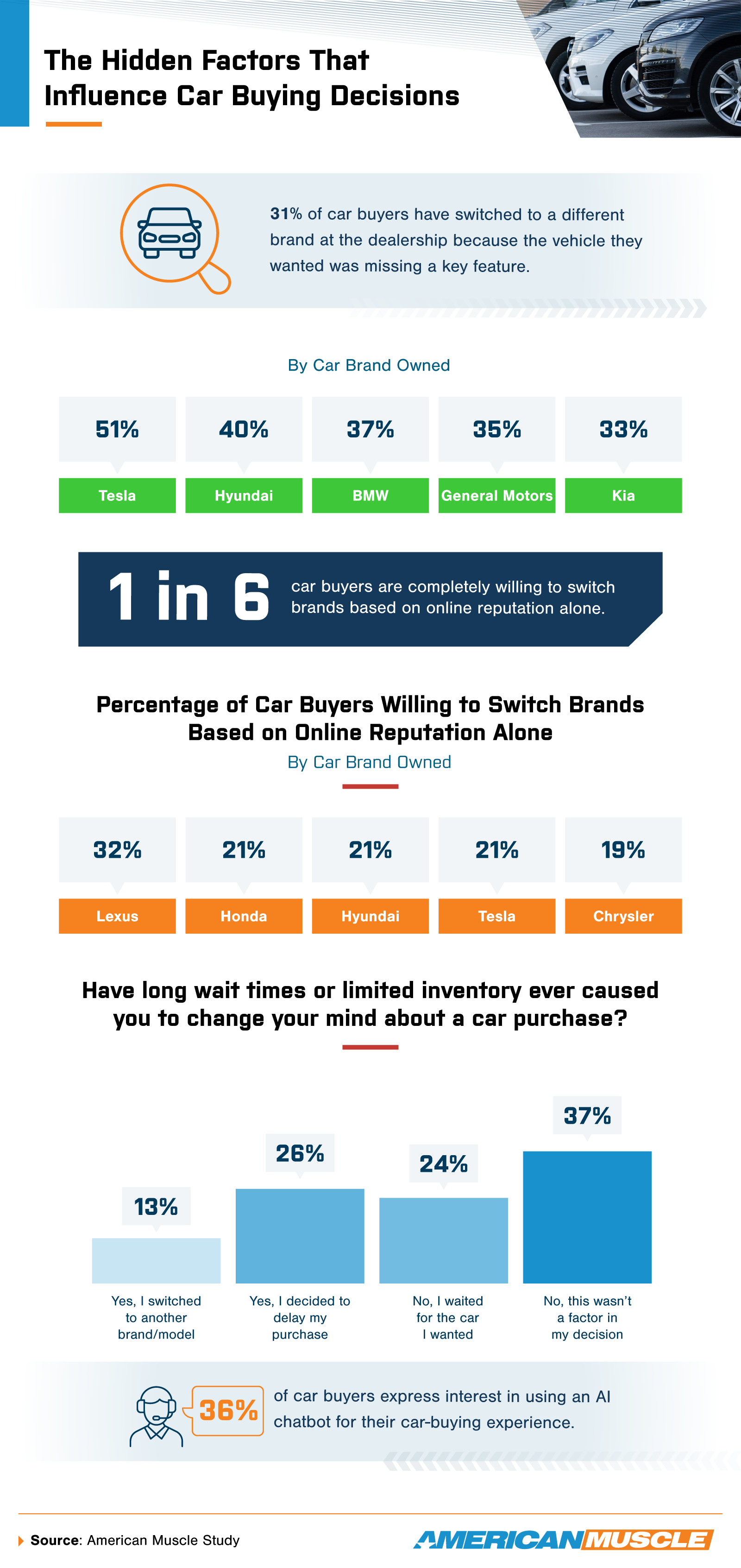

Many car buyers have a favorite brand, but a missing feature or a bad dealership experience can make them change their minds. More shoppers are also turning to AI to help them choose the right car.

Almost a third of car buyers (31%) have changed brands at the dealership because a vehicle was missing a key feature they wanted. Tesla owners were the most likely to do this (51%). This suggests that they're less brand-loyal compared to other car buyers and are more focused on specific features. If a Tesla model lacked something they wanted, they were more likely to choose a competitor instead. The same number of Tesla owners (51%) also said they felt pressured into buying a car they weren't completely sure about — something 38% of all buyers have experienced.

AI is also starting to play a bigger role in car shopping. More than 1 in 4 buyers (26%) said they would trust an AI car recommendation over a salesperson's advice, with Gen X (28%) being the most open to it and Gen Z (23%) the least. Interest in AI chatbots is also growing, with 36% of buyers saying they'd use one while car shopping. Gen X (40%) was again the most likely to be on board, while Gen Z (26%) was the least interested.

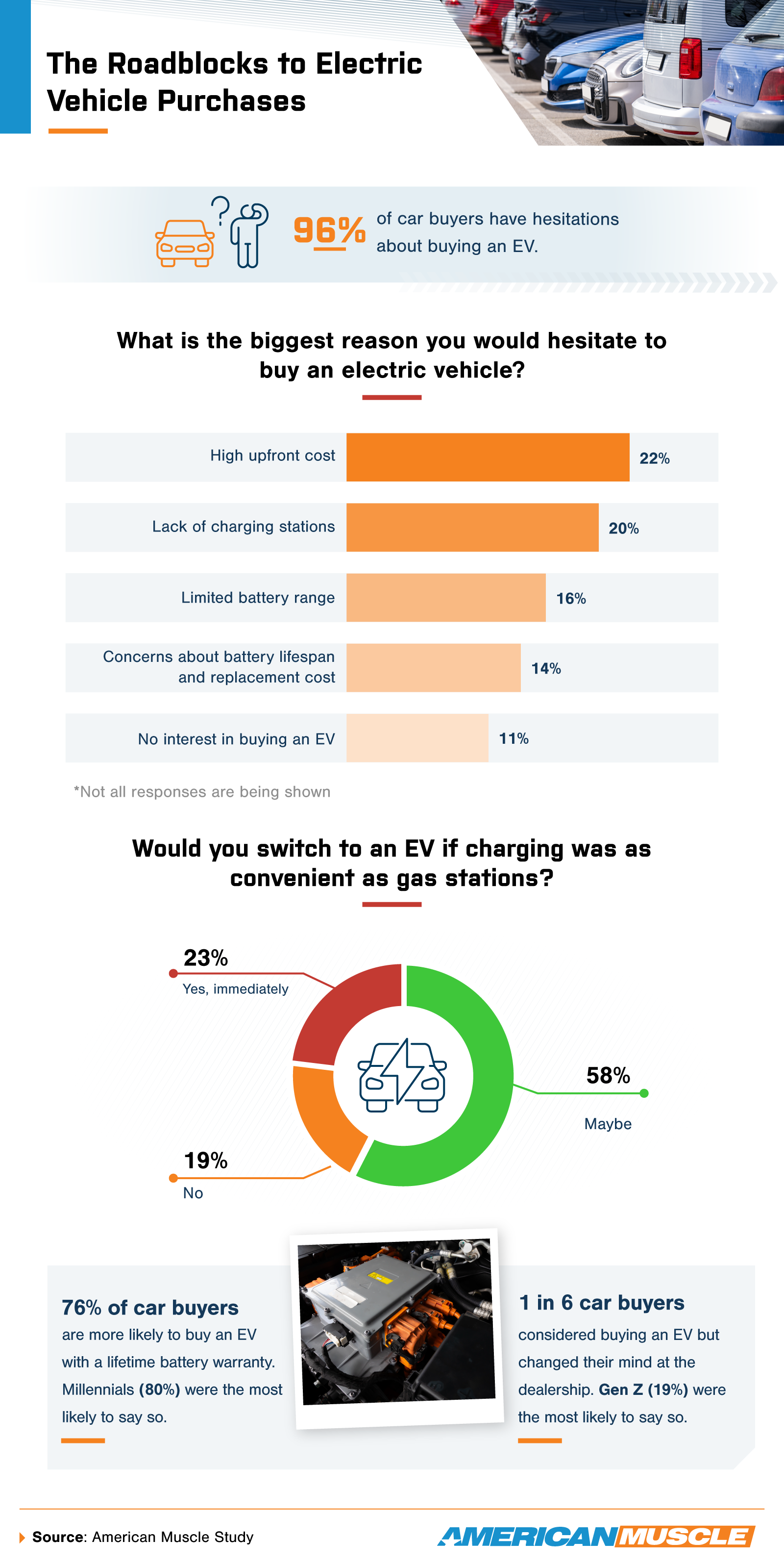

The Dealbreakers Stopping EV Buyers

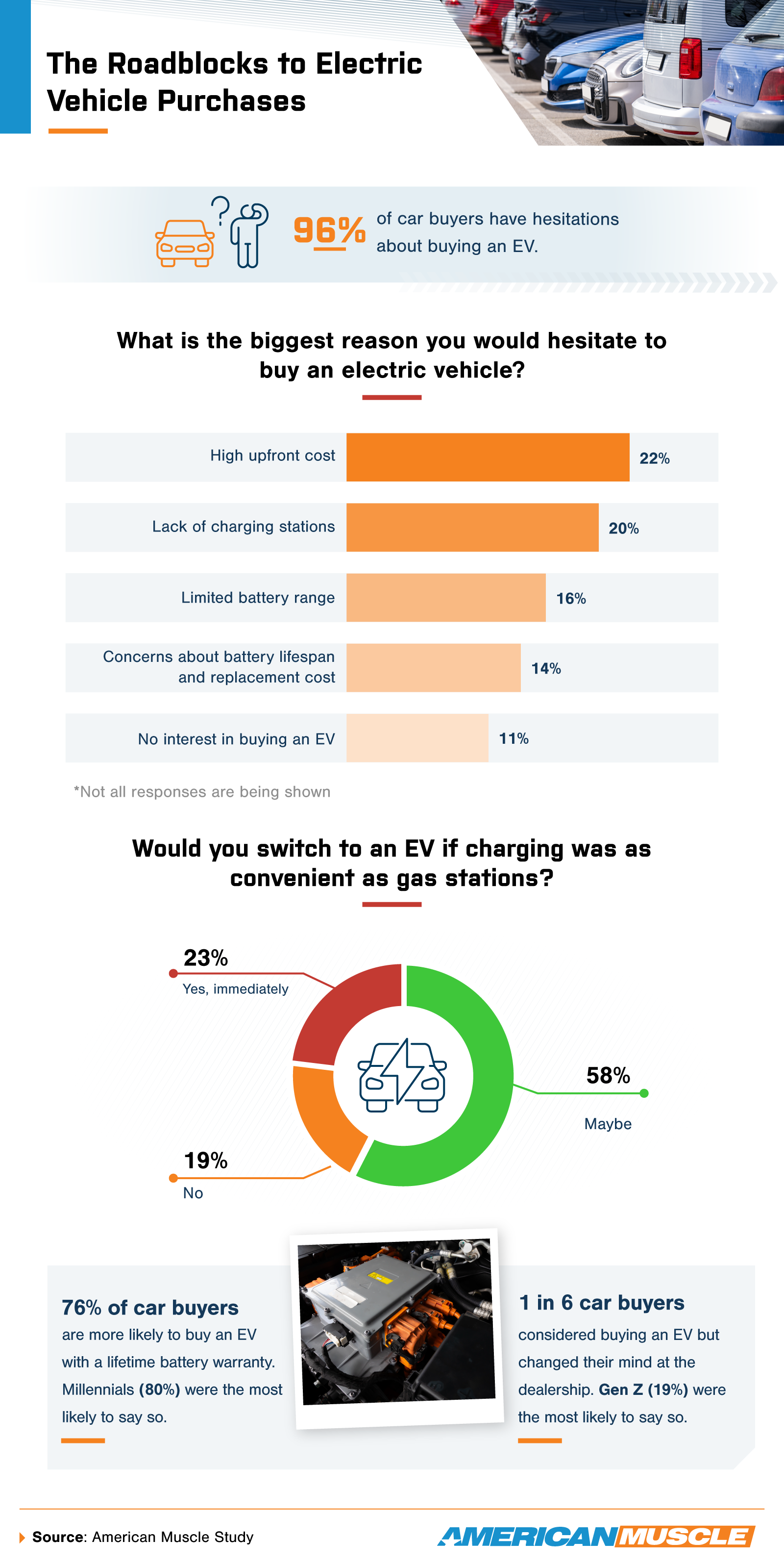

Some car buyers have considered switching to an EV but ultimately decided against it. In fact, 1 in 6 buyers who initially planned to go electric changed their minds at the dealership.

The biggest dealbreakers for EV buyers? High upfront costs (22%) and limited charging station availability (20%). EV cost concerns were most common among Gen Z (25%) and millennials (23%), while Gen X (22%) and baby boomers (13%) were less deterred by them. Gen Z (23%) and millennials (22%) were also more concerned about charging access than Gen X (15%) and baby boomers (14%).

Batteries were also a top issue. Some potential buyers hesitated to get an EV due to concerns about battery range, lifespan, and replacement costs. For others, charging convenience could be the deciding factor.

If public chargers were as accessible as gas stations, 27% of millennials, 24% of baby boomers, 22% of Gen Z, and 17% of Gen X said they would buy an EV right away. But some buyers were still hesitant. Baby boomers were the most likely to say they wouldn't get an EV even if charging was as easy as refueling a gas car, suggesting that their concerns go beyond convenience.

Car Buyers' Breaking Points

Every car buyer has a breaking point, whether it's price, missing features, or EV-related concerns. Some are willing to switch brands to get what they want, while others walk away entirely. Younger shoppers are more open to change, but cost and convenience still give them pause. As the auto industry moves forward, understanding what makes buyers hesitate could be the key to winning them over.

Methodology

We surveyed 1,006 Americans who are currently in the market for a vehicle or have seriously considered purchasing one in the past 12 months to explore their car buying decisions. The generational breakdown was 17% Gen Z, 50% millennials, 26% Gen X, and 7% baby boomers. The data was collected in March 2025.

About American Muscle

American Muscle is a leading performance parts and accessories retailer offering a wide range of products to enhance the style, performance, and functionality of iconic muscle cars.

Fair Use Statement

You may share this data for noncommercial purposes if a link to the page is provided.