Peer-to-peer car-sharing platforms like Turo are shifting how Americans think about car ownership. A recent nationwide survey uncovered key insights into public perceptions, including motivations for using car-sharing services, trust issues, and the influence on car buying and selling behaviors. This exploration sheds light on how these platforms are reshaping car culture and mobility today.

Key Takeaways

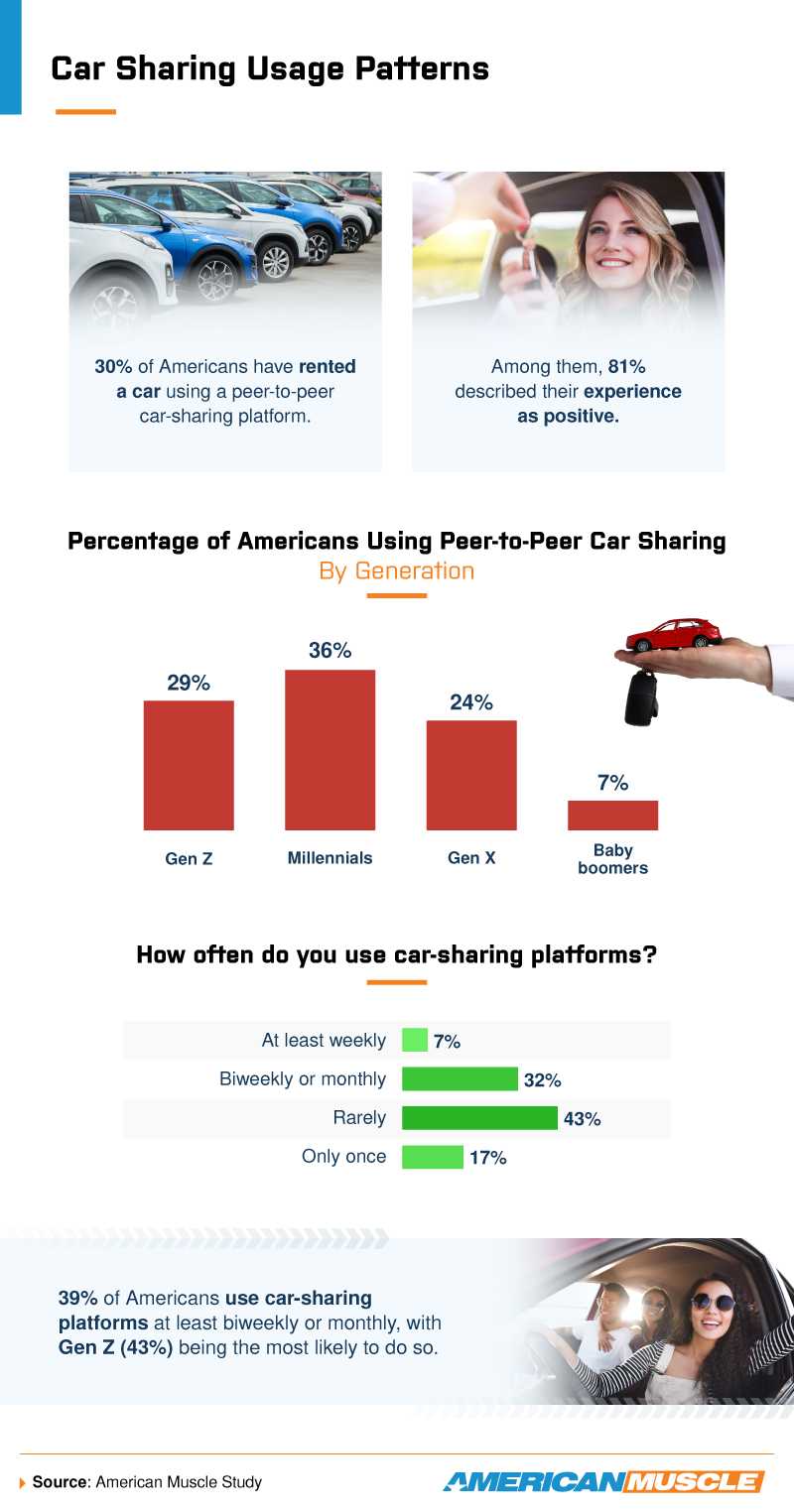

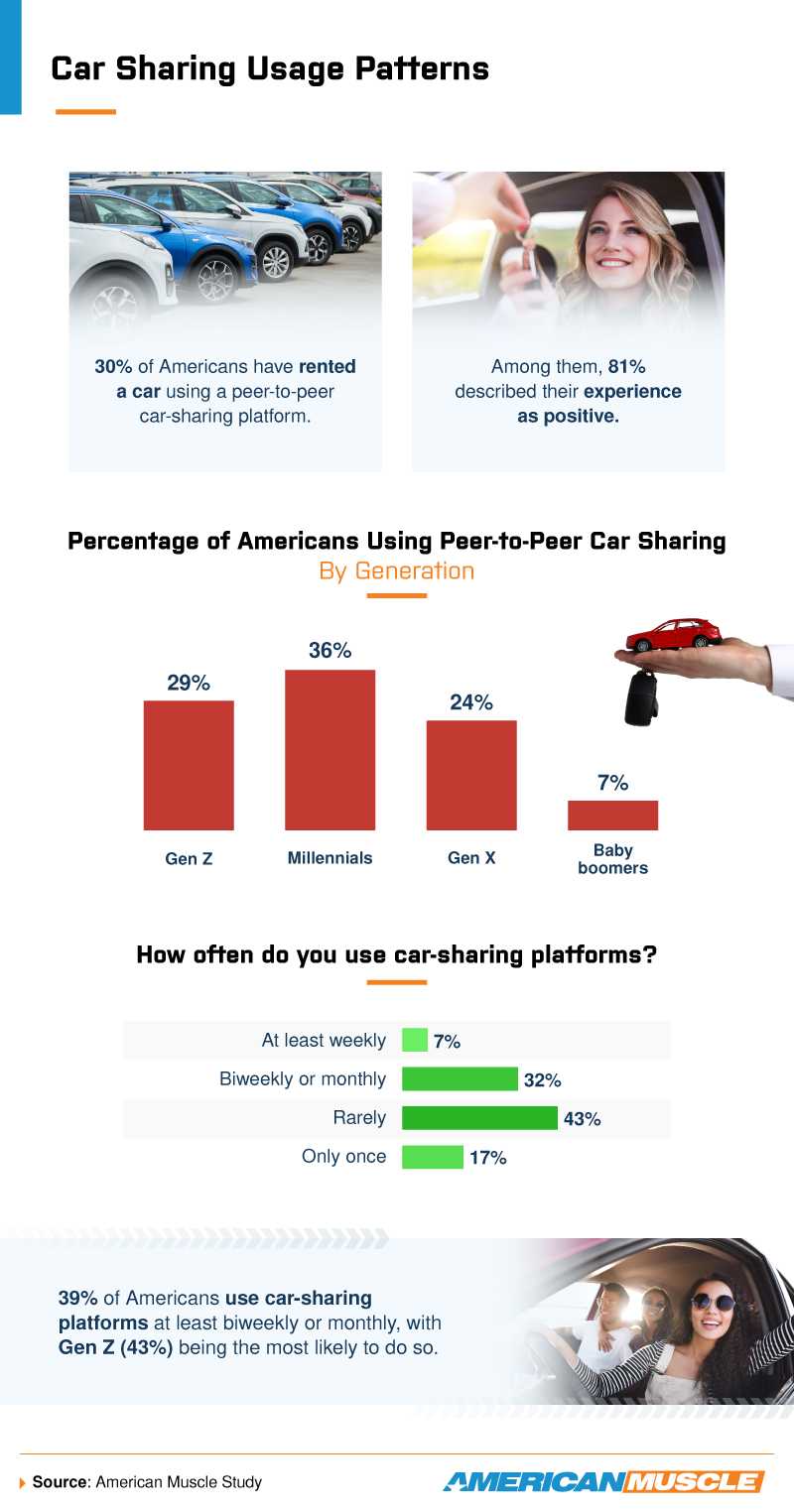

- 30% of Americans have rented a car through a peer-to-peer car-sharing platform, with millennials (36%) leading compared to Gen Z (29%) and Gen X (24%).

- 39% of Americans use car-sharing platforms at least biweekly or monthly, with Gen Z (43%) being the most likely to do so.

- Convenience (63%) and cost savings (62%) are the top reasons Americans prefer peer-to-peer car-sharing platforms, while trust and transparency (68%) dominate preferences for traditional rental agencies.

- 27% of Americans purchased or considered leasing a car model after a positive car-sharing experience.

- 17% of Americans sold a car they previously owned following their experience with car-sharing.

- 20% of Americans decided against purchasing a car due to the availability of peer-to-peer car-sharing platforms.

Who Uses Car-Sharing Platforms and How Often

- 30% of Americans have rented a car through a peer-to-peer car-sharing platform, with millennials (36%) leading compared to Gen Z (29%) and Gen X (24%).

- Among them, 81% described their experience as positive, 15% felt neutral, and 4% had a negative experience.

- Men (37%) were more likely than women (22%) to have rented a car using a peer-to-peer car-sharing platform.

- 39% of Americans use car-sharing platforms at least biweekly or monthly, with Gen Z (43%) being the most likely to do so.

- Only 6% of Gen Z and 8% of Millennials use car-sharing platforms at least weekly.

- Among Americans who use peer-to-peer car sharing, 66% have not encountered any issues. However, for those who have (34%), the most common problems were:

- Vehicle not as described (13%)

- Delay in pick-up or drop-off (10%)

- Damaged vehicle (9%)

- 32% of car-share users admitted to exceeding the speed limit during their rental.

- 50% of car-share users reported responsible behavior, with Gen Z (64%) being the most likely to say so.

Car Sharing vs. Traditional Rentals

- Convenience (63%) and cost savings (62%) are the top reasons why Americans prefer peer-to-peer car-sharing platforms, while trust and transparency (68%) dominate preferences for traditional rental agencies.

- 42% of users believe cars rented through peer-to-peer platforms are properly maintained.

- 20% of Americans decided against purchasing a car due to the availability of peer-to-peer car-sharing platforms.

- 17% of Americans, including 18% of Gen X users, 17% of millennials, and 13% of Gen Z, sold a car they previously owned following their experience with car-sharing.

- 27% of Americans, including 33% of Gen X, 26% of Gen Z, and 24% of millennials, purchased or considered leasing a car model after a positive car-sharing experience.

- 24% of millennials decided against purchasing a car after using a peer-to-peer car-sharing platform compared to Gen X (16%) and Gen Z (11%).

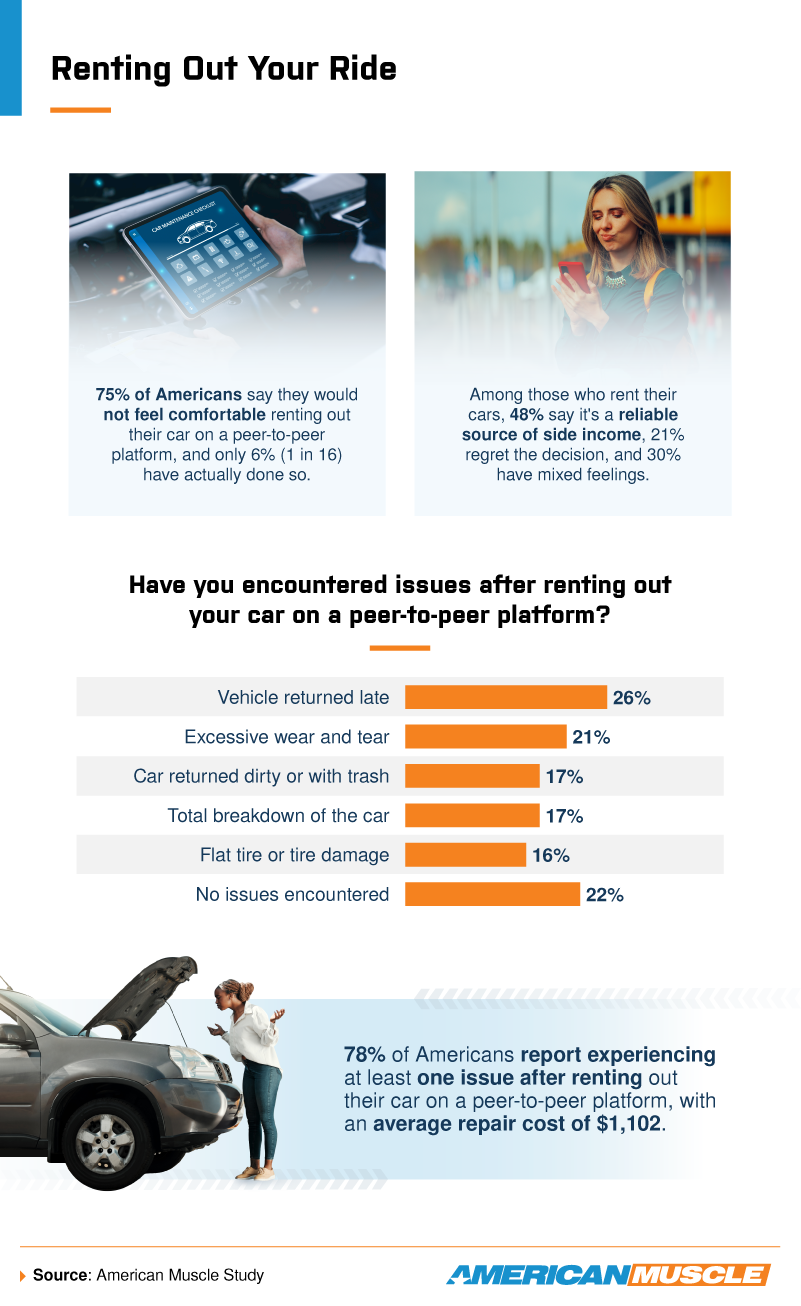

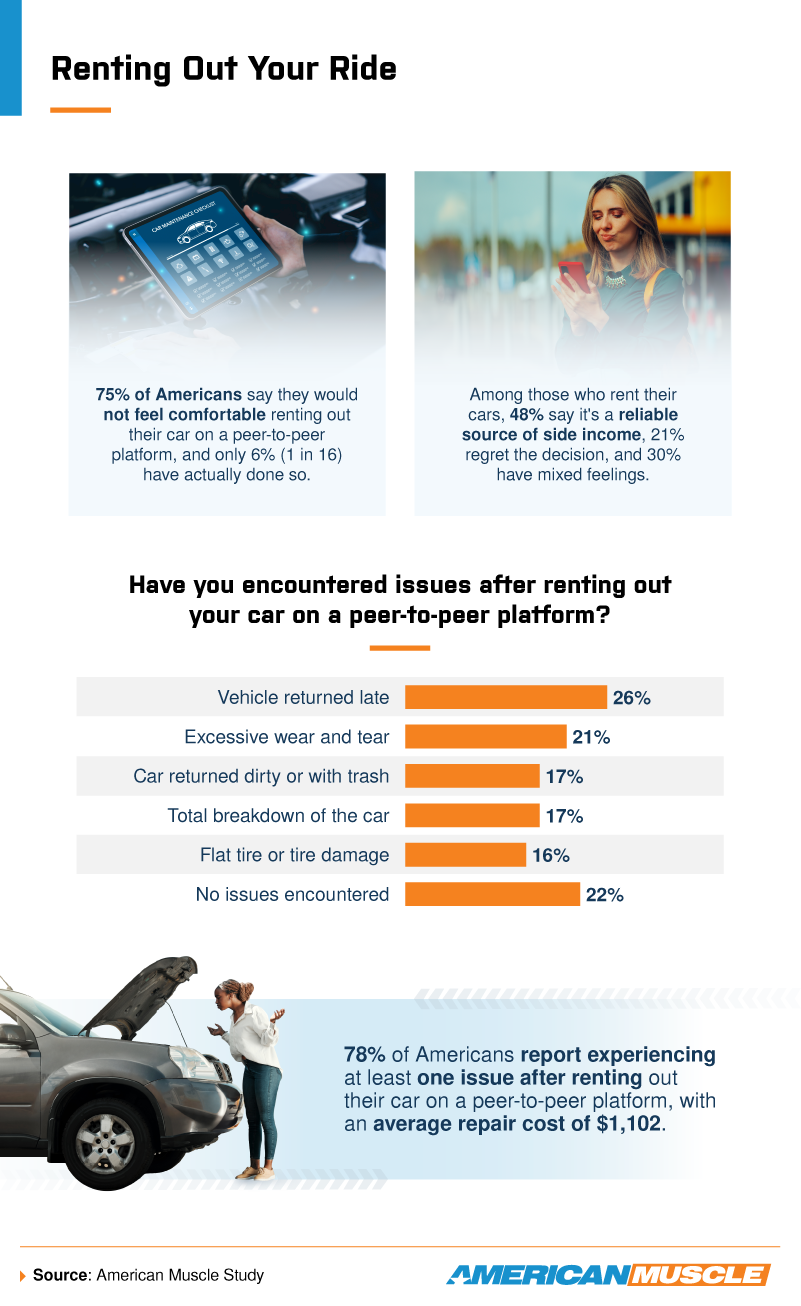

Risks and Rewards of Renting Out Your Car

- 78% of Americans encountered at least one issue after renting out their car, with the most common problems being late returns (26%) and excessive wear and tear (21%).

- 75% of Americans say they would not feel comfortable renting out their car on a peer-to-peer platform. By generation:

- Baby boomers (80%)

- Gen X (83%)

- Millennials (74%)

- Gen Z (64%)

Methodology

We surveyed 1,001 Americans to explore consumer behaviors, attitudes, and trust around peer-to-peer car-sharing platforms like Turo. Of the respondents, 47% were women, and 53% were men. The generational breakdown was as follows:

- Gen Z: 16%

- Millennials: 53%

- Gen X: 25%

- Baby Boomers: 5%

The survey was conducted in January 2025.

About American Muscle

American Muscle is a leading performance parts and accessories retailer offering a wide range of products to enhance the style, performance, and functionality of iconic muscle cars.

Fair Use Statement

Feel free to share these findings for noncommercial purposes, but be sure to include a link back to this page.